Market Overview

Africa has a huge opportunity for FinTech investments and their growth. Several economic and demographic factors, including lack of developed financial infrastructure, the unbanked population of more than 65%, a higher population growth rate globally, and an increasing ratio of population below 35 years of age who are primarily technology-friendly and prefer new technologies for their day-to-day work, are impacting the growth of FinTech adoption in the African region.

Africa has already shown that they are ready to adopt the latest financial technologies by recognizing it as one of the regions with the highest mobile money and digital payments penetration globally. The region is already experiencing high growth in mobile-based financial services. The FinTech adoption is mainly driven across key countries, including South Africa, Kenya, Nigeria, and Egypt. Other African counties, such as Uganda, Ghana, and Rwanda, are also joining the bandwagon, and the growth is accelerating across the region. Though payments are the highest adopted FinTech segment, other segments, including blockchain, digital lending, neobanks, InsurTech, and RegTech, also gain traction in the region.

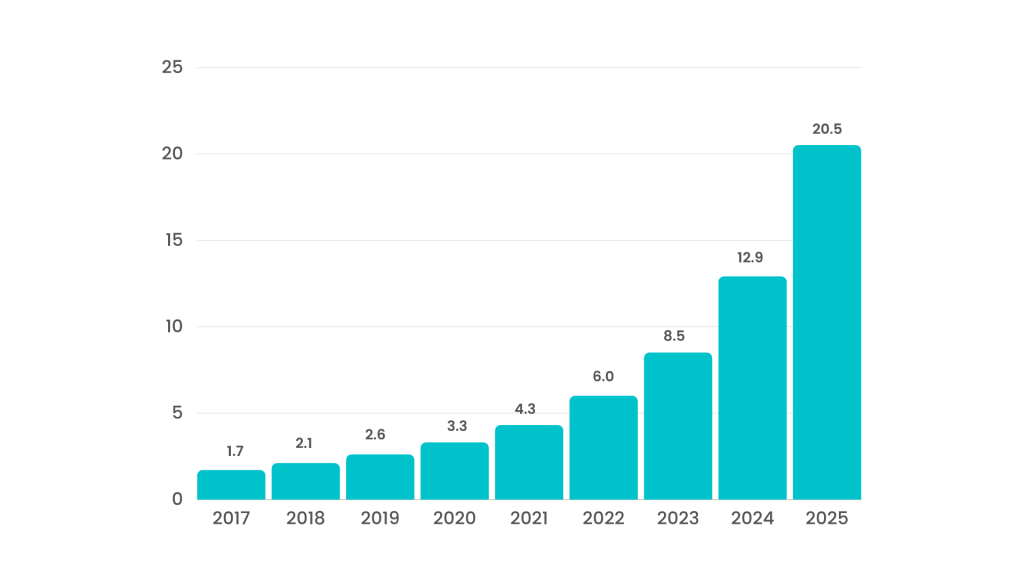

As per our estimates, the market value of FinTech in Africa is expected to cross US$ 20 Billion by 2025, with a CAGR (Compounded Annual Growth Rate) of 44% from 2020-2025.

Africa FinTech Market Size (US$ Mn)

Source: Velox Consultants

Impact of technology

Technology helps the banking and financial services industry proliferate, enabling banks and Fintech companies to move into more functional areas, such as small business lending, formerly the area of local banks. The tech revolution has been a solid demand to adapt and incorporate emerging technologies, including AI, Big Data, and Cloud Computing.

Today, visiting a bank branch has become a distorted version of the past, while Fintech and banking’s future lies in Smartphone applications. Consumers increasingly demand easy digital access to their bank accounts, particularly on mobile devices. To satisfy these modern demands, leading banks are implementing technology.

A few of the technological advancements in the Fintech sector are as follows:

Artificial Intelligence (AI): Fintech has gained immensely from embracing newer technologies like AI, resulting in lower expenses and more sales across multiple channels. AI also allows financial institutions to make more efficient lending decisions and handle risk better. This framework interacts with other technologies, such as big data analytics, voice interfaces, RPA, etc. Besides, AI is also instrumental in enhancing the protection, prevention, and detection of fraud for financial institutions. The technology facilitates mitigating risk and managing lending decisions for financial institutions and is central to making other technologies work. It is also the best source for collecting data regarding customers.

Big Data: With the increasing amount of data banks produce, obtaining actionable insights that can lead to suitable prospects is becoming difficult. Big Data lets banks know best about their customers, helping them make business decisions in real-time by evaluating consumer purchasing patterns, sales management, marketing strategies, product cross-selling, fraud detection, customer feedback analysis, and many more. Besides, it helps to recognize the latest industry dynamics and streamline internal risk control procedures.

Cloud Computing: Cloud banking is the futuristic weaponry that banks would like to embrace. This is primarily because they want to reduce costs across the retail & corporate banking segments and deliver better product & service offerings. With the support of API integration, which can be easily incorporated with neobanks quickly, new product launches would become faster. They will be the main differentiating factor in the cloud banking space. More development and technological innovations will help banks meet the regulatory and enforcement framework defined by the Central Bank. Like GDPR in European countries or CCPA regulations in the US State of California, banks must comply with unique regulations and store data in the appropriate geo-locations accordingly.

Emerging trends of Africa Fintech

Blockchain: The financial services industry adopts Blockchain technology to provide a better customer experience, achieve process efficiency, reduce business risks, and save time and costs.

RegTech: Financial services institutions deploy RegTech to address risks and regulatory challenges, mainly associated with money laundering, lending process, and trading, to lower business and financial risks.

Neobanks: Neobanks or Challenger Banks, digital-only financial institutions, offer various benefits over traditional banks, such as faster processing time, lower costs, and convenience.

Digital Lending: Digital lending plays a vital role in the FinTech ecosystem. It targets mainly tech-savvy millennials, MSMEs, and rural/remote areas by reducing loan processing and documentation requirements.

InsurTech: InsurTech or Insurance Technology companies disrupt the insurance space by leveraging emerging technologies such as advanced analytics, Artificial Intelligence (AI) and the Internet of Things (IoT).

VC Funding Trends in Africa Fintech:

Africa has become an investment powerhouse for local and international investors. According to recent studies, industry sectors in Africa that received the highest funding in 2020 are FinTech, HealthTech and CleanTech. FinTech received over 25% of the total VC funding in the region in 2020, among all investment activities. With almost 80% of the total Africa FinTech investments, the top three countries are Nigeria, Kenya, and Ghana. In 2020, African FinTech firms received more than US$350 Million of funding in close to 95 deals. It was almost 25% of growth as compared to 2019. (Source: Partech Partners)